Today's global challenges call for change and concrete actions from all of us. 2030 is the year when we must achieve the Sustainable Development Goals (SDGs). Museon-Omniversum is committed to contributing to a livable planet for all.

We inspire new generations to engage as active global citizens. Impact, that's what we are all about. But we can't do it alone. To achieve our shared ambitions on sustainable development, we therefore bridge the gap with the business community. Here, we provide insight into how we intend to shape this initiative, together with our new partners.

Get involved

You would like to make your business more sustainable and include your customers, employees and suppliers in that process. In order to have a positive impact on society. Within a partnership with Museon-Omniversum, we will inspire each other, learn from each other and act together.

Find inspiration for sustainable and socially responsible business in our activity programmes such as the One Planet Talks and business roundtables around relevant themes. Learn from young people, policymakers, NGOs and other businesses. Evaluate your progress at our annual valueholder meetings and set new goals for the future.

Together we have more impact

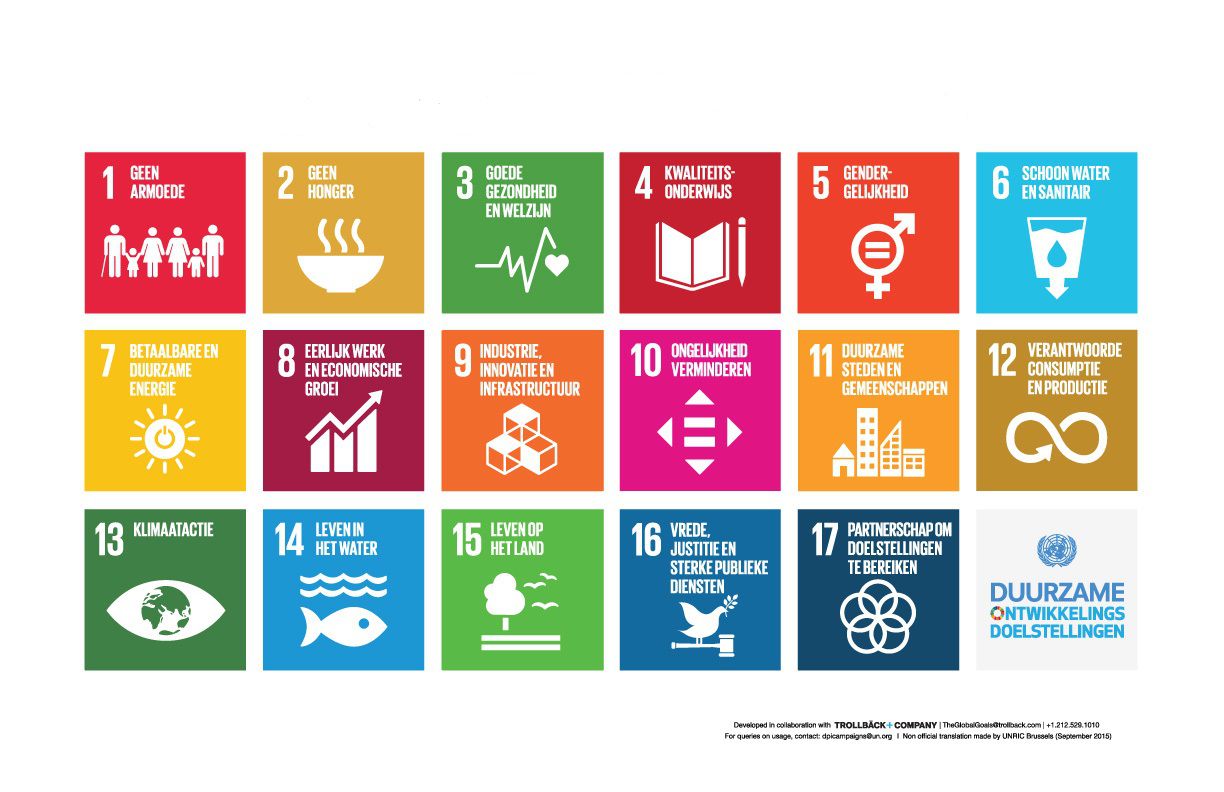

Museon-Omniversum wants to connect with other organisations to jointly increase our social value and drive sustainable development based on the 17 SDGs.

Besides government, NGOs, scientists and visitors (consumers, families and schoolchildren), companies are important stakeholders for Museon-Omniversum. Together, we create programming and build an impact centre.

The platform MAEX calculated that Museon-Omniversum had a social impact of over €45 million in 2022. That is almost five times more than you can normally expect from an organisation of our size. With our new partnerships, we hope to further broaden and increase our impact.

These are our partners or value owners

- ABN AMRO

- ASN Bank

- CGI

- DNB (value holder)

- Municipality of The Hague

- Groene Groeiers (value holder)

- PENTO

- Rijk Zwaan Zaadteelt en Zaadhandel BV (value holder)

- VFonds

- Dunea

We thank them for their involvement and good cooperation!